Finance Column Rosa Sangiorgio

Chapter 7: Deep-Diving the New Normal – Investing made easy by Rosa Sangiorgio

Investing made easy is a bi-weekly series by Rosa Sangiorgio exclusively for Vivamost

“Oh no, not another article on COVID! What has this got to do with investing?” I hear you ask.

Well, whether you’re re-thinking your business, or deciding where to invest your money, it’s worth considering how the world is changing and what will be needed to create success in the future.

Photo by Edwin Hooper on Unsplash

A team of economists analyzed a strike by London Underground workers in 2014. Before the strike, 5% percent of the travelers were taking suboptimal routes. Forced to experiment with new connections, commuters found quicker routes and the overall efficiency of the network grew. When we’re forced to break with routines, we try new alternatives and some of those will become useful long-term.

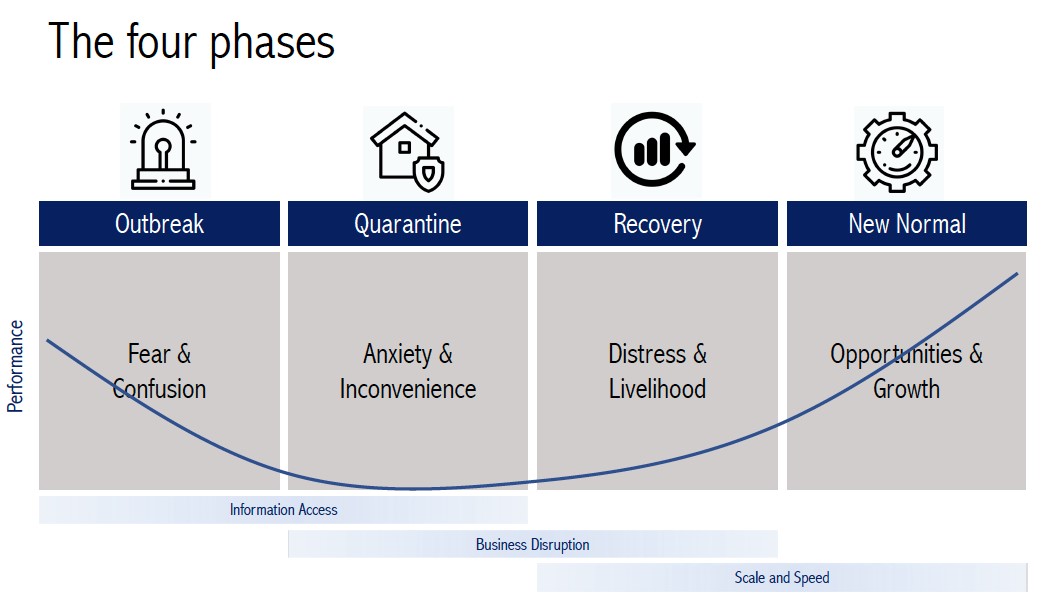

Every crisis has an evolution as in the diagram below:

Courtesy by Rosa Sangiorgio

Outbreak

Covid-19 was a shock, initially, we wanted to understand what was happening and prevent the risk of a pandemic.

The economy rapidly shut down to prevent the spread of infection. Businesses and households adopted coping mechanisms to get by in the short term. Some tried to introduce risk-mitigating technologies and business practices to improve customer and employee safety. Consumers became more willing to pay for safety features. As a consequence, firms could invest in new technologies and designs, even when they were initially inferior in terms of cost or user-friendliness. Winning businesses were those implementing temperature-detection technologies, AI disease spread modeling and symptom-tracking solutions.

Quarantine

After the first weeks of fear, quarantine measures were gradually introduced across the globe. For those businesses that weren’t already digital or automated, this phase led to drastic changes in business models: digital teleworking tools, home-schooling solutions, safe food delivery solutions. Some businesses had no immediate alternative though, the airlines lost 50% of their revenues!

Photo by Dhaya Eddine Bentaleb on Unsplash

Recovery

We’re now mostly in the recovery phase: increasing levels of economic activity, whilst doing our best to address health and safety risks. Often questioning if it’s too early and whether we will need to lock-down again soon.

Businesses have implemented pre-booking to control customer flow, grocery stores have installed plexiglass shields, face-to-face meetings have been replaced by video conferences.

Additionally, firms are developing and experimenting with robots to deliver medicines in hospitals, technologies that combine computer vision and AI to bill customers directly as they walk out of the stores (no checkout required), virtual experiences expanding to ‘travel’, gatherings and more.

The New Normal: Technology and Sustainability

Technology and Sustainability were already key themes before the crisis, and their evolution has been accelerated by the Covid-19. My personal opinion is that they will be key in shaping the next New Normal and therefore what we want to invest in today.

Artificial Intelligence, DNA sequencing, Robotics, Energy Storage, Blockchain Technology, are at the tipping point of a cost drop that will bring them mainstream. The convergence of these technologies is expected to unlock around 50 trillion USD in economic productivity. Something like 1975 for computers or 1994 for the internet!

Photo by Christina @ wocintechchat.com on Unsplash

Similarly, the 17 UN Sustainable Development Goals (SDGs) set by the UN in 2015 to achieve a sustainable future by 2030 are bringing a sea change. Achieving the SDGs is now considered essential for sustainable economic growth and represents up to 21 trillion dollars in new economic opportunities. The SDGs now show in 72% of companies’ reporting and are the universal framework for contributing toward a sustainable and inclusive future.

From physical to digital

COVID-19 pandemic has accelerated change in digital commerce, telemedicine, and automation.

Did your father start buying books online for the first time? My father did! In Italy alone, e-commerce transactions have risen 81 percent since the end of February.

The figures for telemedicine and virtual health are equally striking. Not only are telehealth providers doubling their registrations, but countries (e.g. France and Korea) are changing regulations to ease access to telemedicine.

It is not unreasonable to envision a world of business, from the factory to the consumer, in which human contact is minimized, but definitely not eliminated: for many of us, getting back to “normal” will include popping into stores again. Patients with complex needs will still see their doctors in person, and many jobs are not automatable.

Credits: www.keckmedicine.org

From global to local

In the past years, technology made it possible to communicate and work dramatically reducing the necessity of physical proximity. Nevertheless, already before the Covid-19 crisis, there were signs of unease with globalization, expressed in protectionism and more restrictive immigration policies. Now, to deal with the pandemic, governments have imposed unprecedented, severe restrictions on people and goods. This means a greater preference for local over global products and services, with the need for resilience across supply chains bringing sourcing closer to end markets.

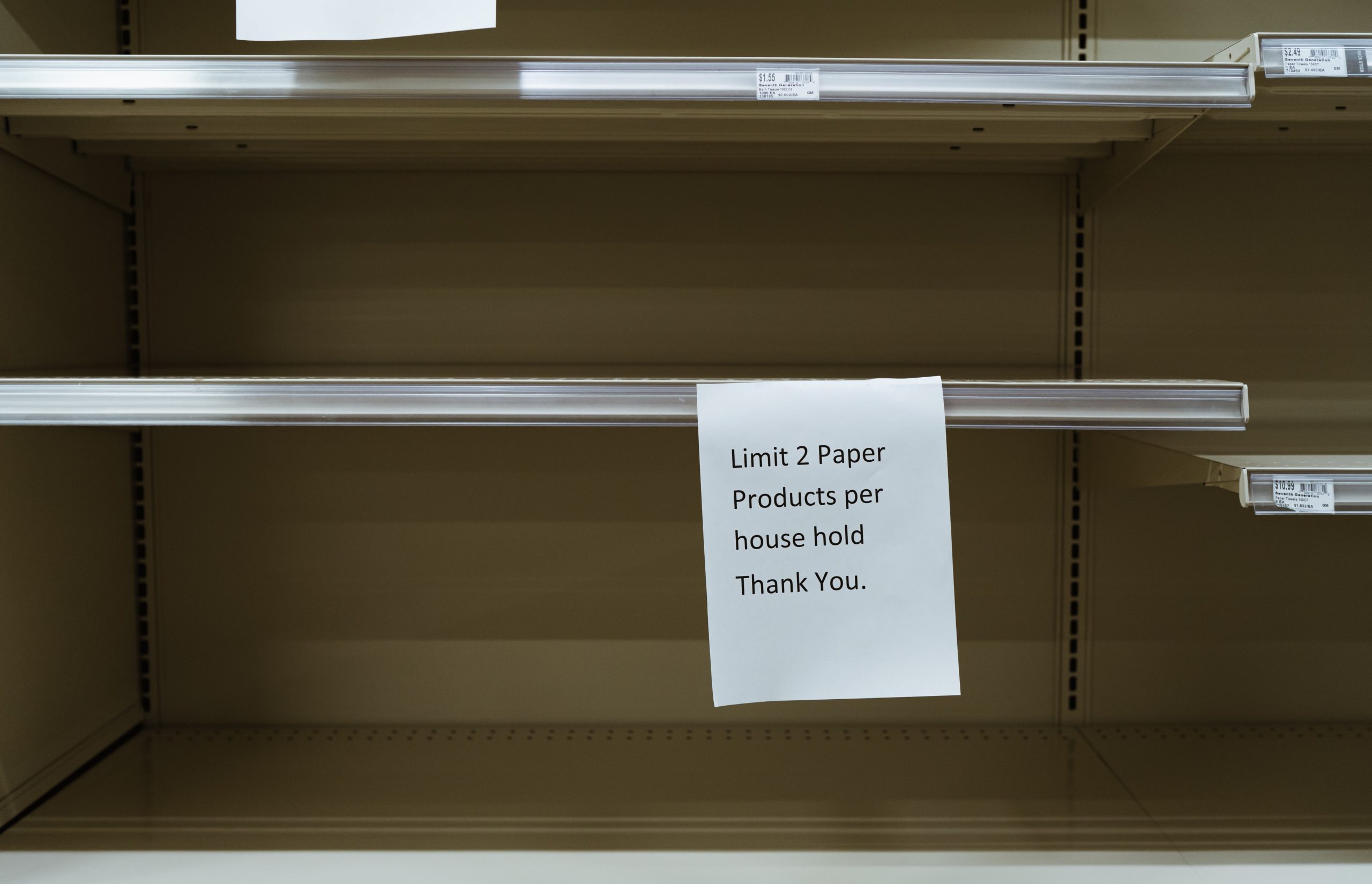

From efficient to resilient

Even when lockdown restrictions begin to ease, businesses will operate in new ways. Think about the toilet paper shortage… In general, companies have suffered because they couldn’t get the supply they need. This happened because their supply chains were built on just-in-time inventory. This is being reconsidered.

Photo by Allie on Unsplash

Additionally, the impact of climate change is increasingly being recognized by business leaders and investors. The pressure to include environmental, social, and governance factors in valuing a business is now also including resilience to outside shocks, such as pandemics. Resiliency is becoming as important as cost and efficiency.

From individual to collective

During times of great crisis, such as World War II, citizens have accepted greater government control of the economy. During Covid-19, there has been an economic intervention that hasn’t been seen for decades directed to supporting citizens’ basic needs, preserving jobs, and helping businesses to survive. Some countries are nationalizing, some providing loans, and others regulating.

Business leaders now have to adjust to greater government intervention.

Photo by Branimir Balogović on Unsplash

From market driven to goal-driven

Rightly or wrongly, there is a perception that during the financial crisis of 2008, financial institutions were culpable for the trauma, accepted billions from governments and taxpayers, and gave little back. Now citizens all over the world could face higher taxes in order to pay for the trillions committed by the governments to sustain the economies. The public will demand their money to be used for the benefit of society at large. The coronavirus could be the biggest global challenge since World War II. As our grandparents had to answer the question: “What did you do during the war?” That question will be asked to us in the future regarding the pandemic.

No one knows what will happen. It could be that decisions taken during and after the crisis will lead to less prosperity, slower growth, widening inequality, bloated government bureaucracies, and rigid borders. Or perhaps they’ll lead to a burst of innovation and productivity, more resilient industries, smarter government at all levels, and a reconnected world. Neither is inevitable and the outcome will probably be a mix.

In any case, where the world will be is a matter of choice, our choices as individuals, companies, governments, and institutions. As such the scenario that we will innovate and act more sustainably seems plausible to me, even if I take off my pink-glasses for wishful thinking.

Photo by Devon Janse van Rensburg on Unsplash

Useful links and sources

- Business Strategy Through Four Phases Of The Coronavirus Crisis

- The upside of London Tube strikes

- Disruptive Innovation: Why Now?

- About the Sustainable Development Goals

- Building resilient operations

About the Author:

Rosa Sangiorgio, an Independent Advisor, is an expert at scaling investment methods that generate positive, socially responsible and environmental welfare impact in addition to a financial return. She worked for several European Financial institutions in the area of Wealth Management and Private Banking. Also, she was Head of Sustainability and Impact Investing in the Investment Management team of Credit Suisse until January 2020. Rosa is also a CEFA charterholder and TEDx speaker.