Finance Column Rosa Sangiorgio

Chapter 2: No Risk, No Fun – Investing made easy by Rosa Sangiorgio

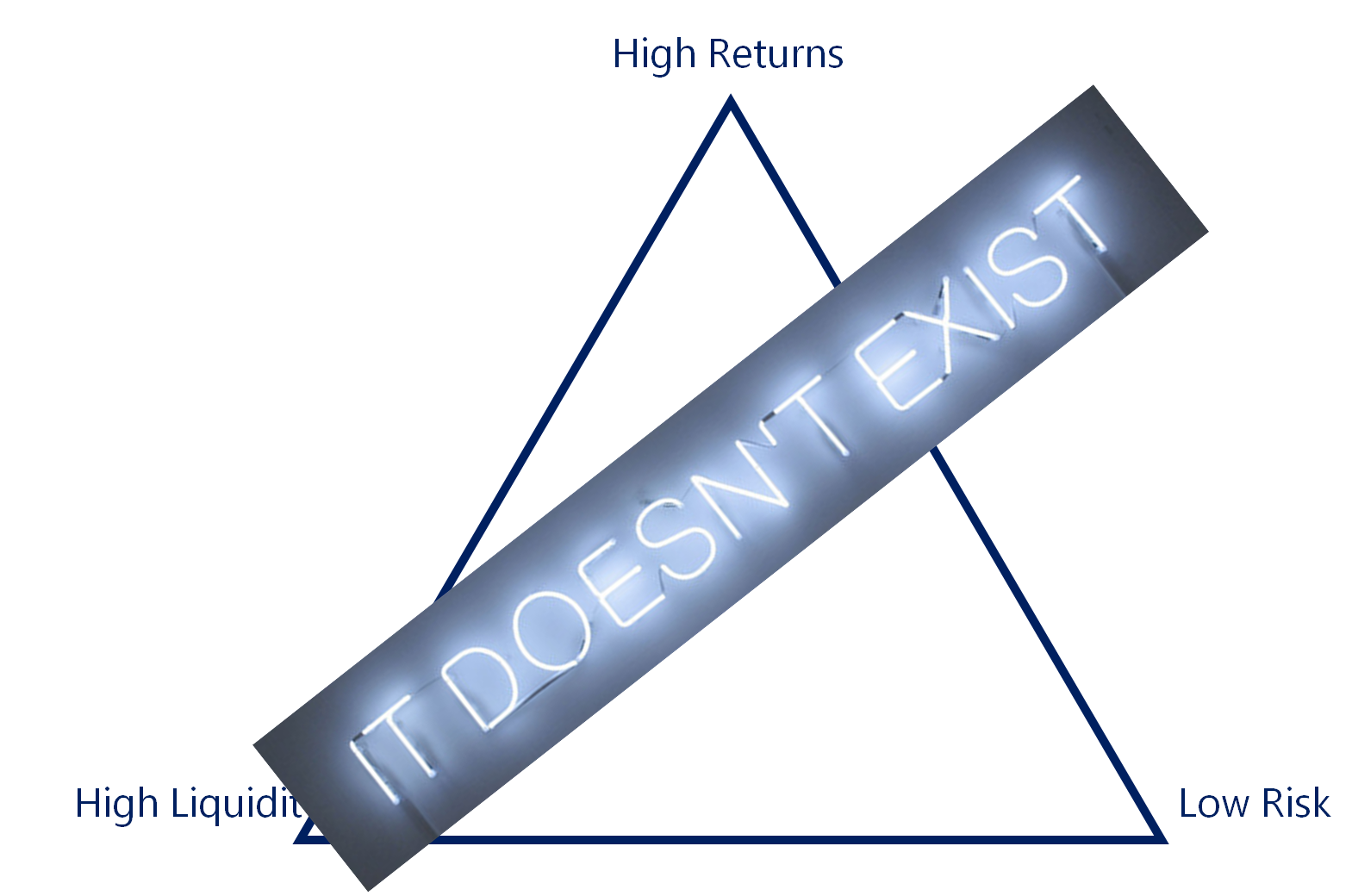

If you have got your feet wet in investing by now, you must be familiar with the term “The Magic Triangle”. The Magic Triangle is used as a compass for investors to evaluate the present and future financial goals: ideally the optimal investment offers high profits, low risk and constant liquidity.

Unfortunately, the magic triangle of investing doesn’t exist, so if you are being offered one, it is probably a scam.

The Magic Triangle | Courtesy: Rosa Sangiorgio

You’re probably now asking yourself: if the perfect investment doesn’t exist, how do I choose where to invest?

As for most things in life… Start with WHY!

Investing your savings means using your money surplus today, to get more money tomorrow. So, why do you need that money tomorrow?

Your why is the key to defining your investor profile and transform your individual preferences in investment decisions. In other words, what’s important when investing is not whether an investment is good per se, but whether it meets your expectations!

There is no such thing as one investment fits all. Different people need to invest differently according to their individual investor profile.

The 3 Cornerstones of your Investor Profile:

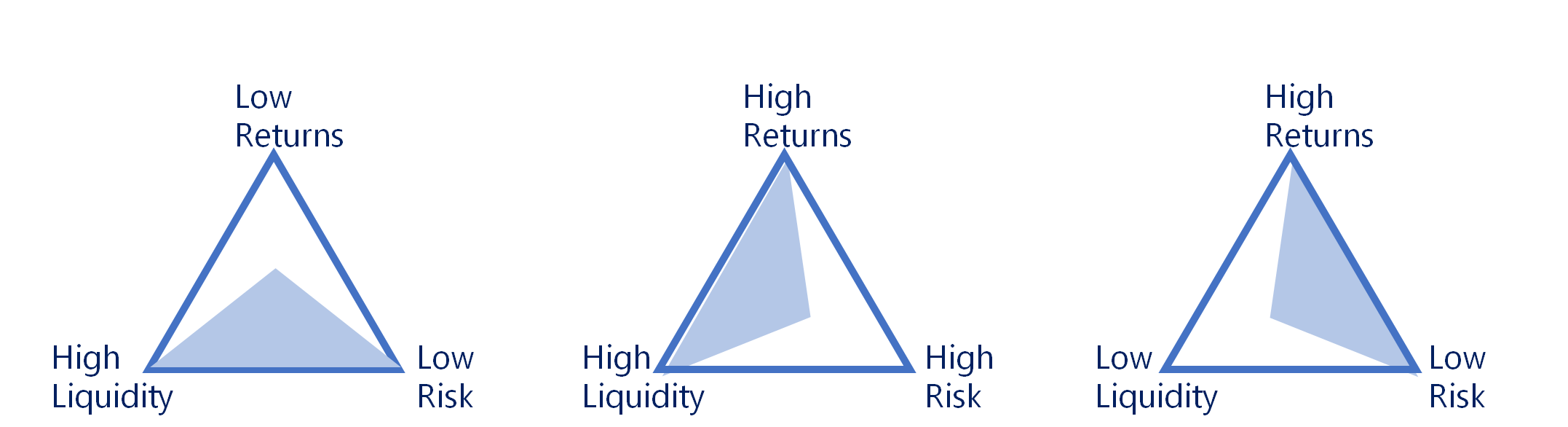

Your investor profile (also called risk profile) represents your very own perspective of the three competing goals of investing (which are also the essential factors used in the evaluation of every investment): security, liquidity and profitability.

As no single investment offers high returns, the upmost liquidity and the highest level of security all at the same time, you will need to weight these different aspects and decide which one should be of greater importance.

Courtesy: Rosa Sangiorgio

Security: A secure investment has a low risk of earning less than you expected. Each of us has his/her own personal risk tolerance. To identify your degree of risk tolerance, ask yourself: How would I feel if the value of my investments was to fall? Am I ok with the value of my investments swinging up and down? Risk is something that most investors try to avoid, but there’s no such thing as risk-free investing. A low-risk investment will have small fluctuations in value, and therefore be more predictable. A risky investment will be unpredictable with larger swings, but can be very remunerative if you are able to wait, as it will likely compensate you for taking on that risk.

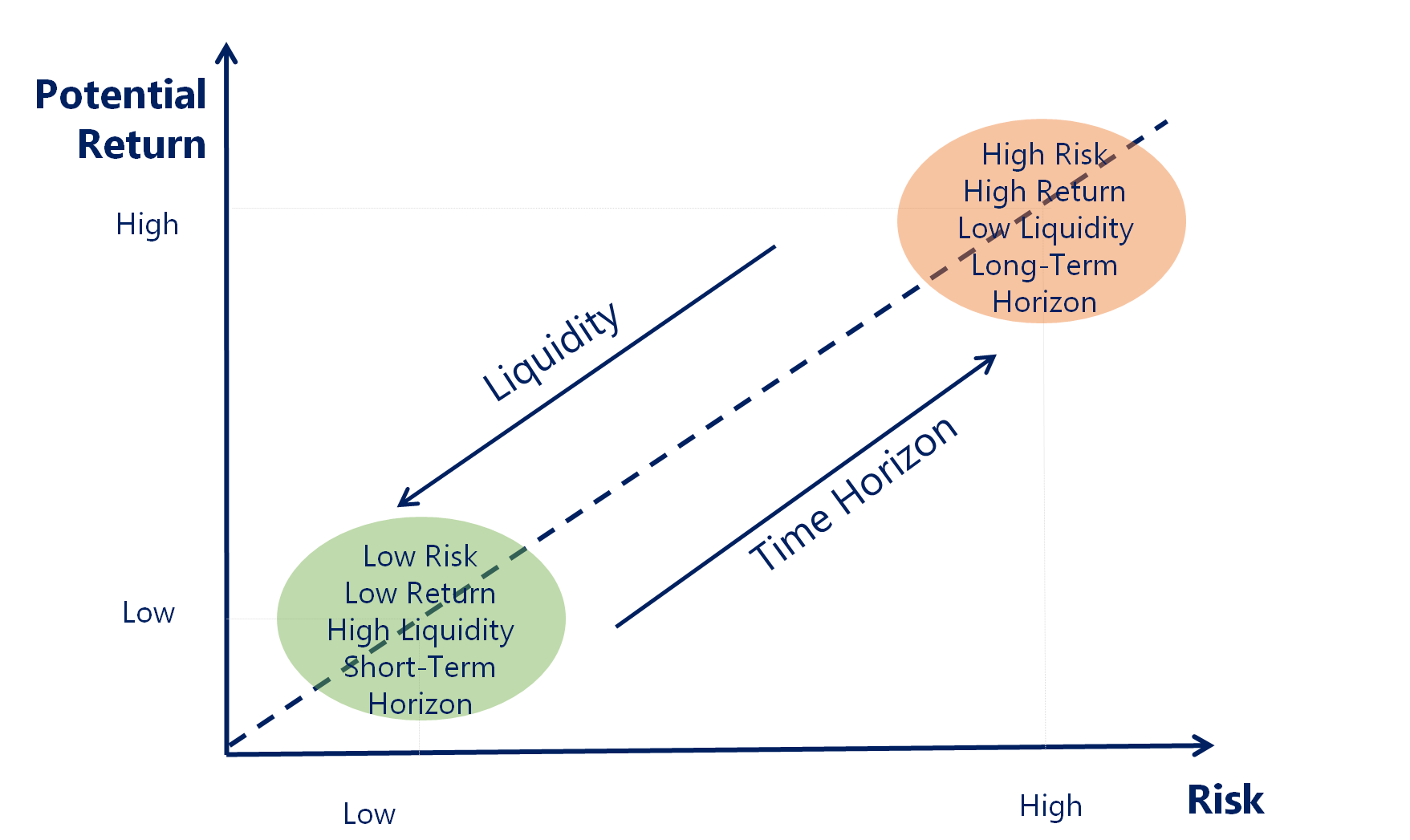

Liquidity: Your liquidity budget is the length of time you can depart with your money before you need it again. Do you need that money to pay for your daughters’ university in 3 years, or will you need that money when you retire in 15 years? Do you need to be able to disinvest at any time, or can you wait patiently for your time horizon? The returns that you get from investing compensate you for the cost of not using that money right now (opportunity lost), so the longer the time horizon, the higher the potential returns. To have your money continuously available, you pay a liquidity premium, so usually the higher liquidity, the lower the return.

Profitability: How much yield are you expecting from your investments? And are you keen on trading some of your potential returns for less risk?

Usually the theory refers to a trade-off between risk and return, boiling down investing in trying to achieve the highest level of return for the lowest level of acceptable risk. Is this it?

Return and Risk | Courtesy: Rosa Sangiorgio

Where is my money going?

Regardless of how you invest your money, you are basically giving that money to a company, government, or other entity believing that they will give you back more money in the future. From their perspective, those entities need your money to implement businesses or ideas that will create value, that’s why they are willing to receive your money today and give you back more money in the future.

Investing is a flow between “people with money” and “people with ideas”

If the idea you are investing in is successful, you will get back more money in the future than you had today; if the idea doesn’t work, it may happen that you don’t get any money back at all.

Would you give someone your money without understanding properly the idea which they have in mind? Would you simply ask to receive back as much money as possible, without caring what your money will be used for? Would you give someone your money for a business that is not aligned with your values or principles?

I wouldn’t!

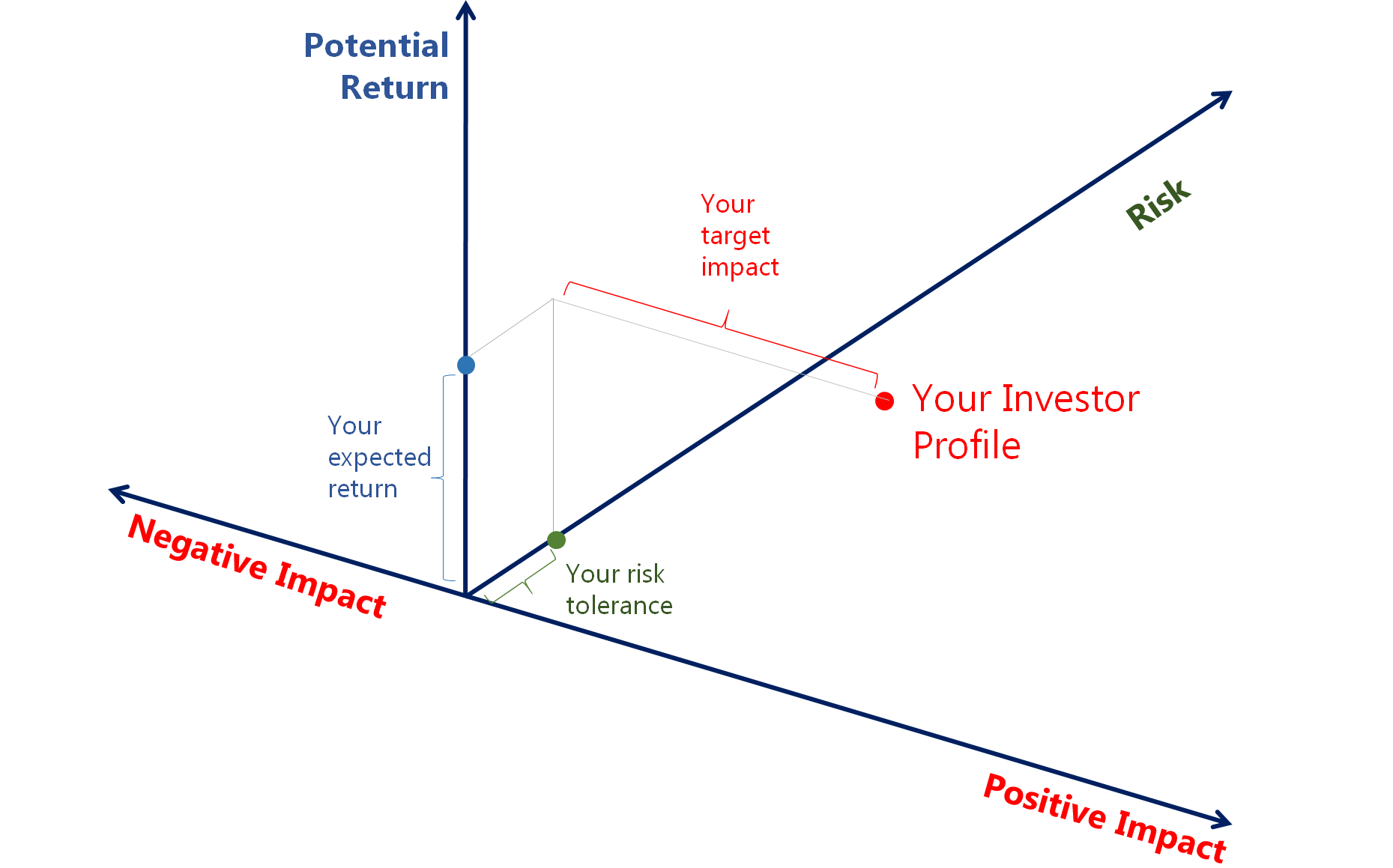

When deciding how to invest, a fourth aspect becomes very important together with risk, return and liquidity: your Values and Impact. It includes considerations like the basic respect of human rights, the will to avoid some industries, the wish to leverage your investments to change the world in the direction you want the world to change.

Positive and Negative Impact | Courtesy: Rosa Sangiorgio

We will explore the topic of values and impact in a forthcoming article, but it’s important to remember that these considerations belong to your investor profile. Your investment decision becomes tri-dimensional: trying to achieve your expected level of social impact and financial return for an acceptable level of risk.

Your turn now! Take your time to reflect upon your own investor profile. Being confident about it will allow you to find the appropriate investment for your individual circumstances. During the next weeks we will explore the range of investment opportunities and understand how to match the different possibilities with your own investor profile. Until then, stay healthy and stay safe!

Courtesy: Rosa Sangiorgio

Other sources of information:

Modern Portfolio Theory—with a Twist: The New Efficient Frontier, Brian Dunn, Aquillian Investments, 2006.

Don’t miss out on the updates on this series. Subscribe to upcoming articles here. Chapter1: Is this the right time to invest? is available under our columns.

About the Author:

Rosa Sangiorgio, an Independent Advisor, is an expert at scaling investment methods that generate positive, socially responsible and environmental welfare impact in addition to a financial return. She worked for several European Financial institutions in the area of Wealth Management and Private Banking. Also, she was Head of Sustainability and Impact Investing in the Investment Management team of Credit Suisse until January 2020. Rosa is also a CEFA charterholder and TEDx speaker.