Career & Entrepreneurship

Chapter 3: Your money, your values – Investing made easy by Rosa Sangiorgio

Photo by Mark König on Unsplash

After last week’s article on how to identify your risk profile, it’s clear now that your investments are not only your “insurance” for bad times, or your “treasure”, but they are also your possibility to contribute and care about the future you create.

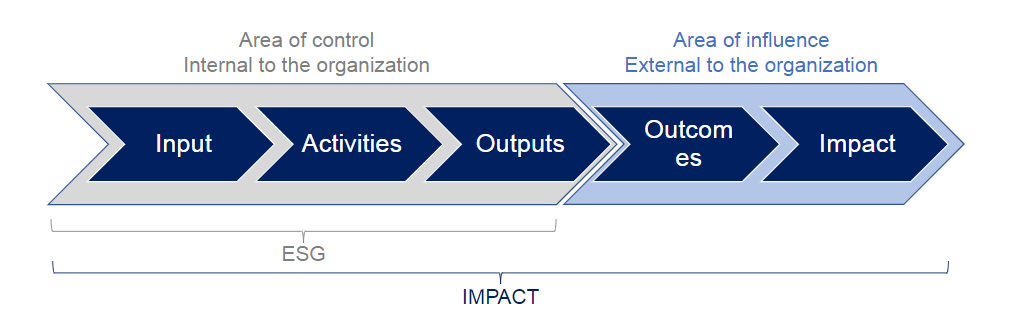

ESG and Impact are not synonymous.

You may have heard already a lot about sustainable investing, with the terms ESG, Sustainability, Responsibility, Impact often used as synonyms, but guess what? They aren’t.

Theoretically, a “universally accepted” definition is not yet there:

- Usually, ESG has more to do with what happens inside the organization: the input, the activities and the output/product; it is mainly about compliance to written and not written rules.

- Impact implies a broader more holistic perspective, weighting both what happens within the company, and what the companies’ activities and products trigger in society and environment (the so-called “externalities”); Impact investing includes intentional and measurable positive social and/or environmental transformation.

Courtesy: Rosa Sangiorgio

Then there’s everything in between, including the “green-washing” and the most recent “green-wishing”… but I will save these topics for another article.

United Nations Sustainable Development Goals

In 2015, the United Nations published a set of 17 distinct, but interrelated, Sustainable Development Goals (SDGs) to guide global development. They’re a blueprint for a fair and sustainable pathway to development that leaves no one behind.

The goals are not mutually exclusive, and addressing one goal may help address others at the same time: for example, addressing climate change will have co-benefits for energy security, health, biodiversity, and oceans. However, the SDGs may also involve trade-offs. For example, biodiversity could be threatened if forests are cut down to expand agricultural production for food security. Food security could be threatened if food crops are switched to biofuel production for energy security. And, that’s how the 17 colorful goals might also trigger conflicting views.

Besides, “How do we collect the data and information that confirms the progress?”, “Who is responsible for meeting final targets?“, “Is it more important to fight climate change or reduce the gender pay gap?”

Courtesy: https://sustainabledevelopment.un.org/sdgs

Controversial or not, the SDGs an admirable effort and a great tool to guide your resources in the one direction that makes sense.

The financing gap to achieve the SDGs in developing countries is estimated to be around USD 3 trillion per year. It may seem a lot, but it’s definitively not if you consider that the global private sector financial assets (all our money put together) are estimated at USD 200 trillion. Furthermore, it is estimated that achieving the SDGs could open between 10 and 20 trillion in market opportunities and create 380 million new jobs.

So the real question is, where are these 200 trillion invested, if not into improving our lives? Good question, isn’t it! Probably a question for your financial advisor, or whoever is managing your Pension Plan.

Each investment we make has an impact, positive or negative, but in over 95% of the cases we are not calculating it, or not transparently communicating it. Yet, we should.

Photo by Brian Miller on Unsplash

Busting Myths about Sustainability and Impact Investing

“Investing sustainably means you have to accept lower returns”

Not true! Numerous studies demonstrate that investments following sustainable criteria earn market returns. Clearly your returns will depend on the quality of the underlying investment, BUT to cut it short: the world is trying to find solutions for climate change, the successful ones will be quite profitable, don’t you think?

“There is no common standard for sustainable investing, we can’t compare apples with pears, better wait!”

My grandma’s answer would be: “perfection is the enemy of good”. Sustainability and Impact frameworks are not perfect today, but improving continuously. Being aware and actively seeking an impact is a journey, a journey with urgency in some cases. So, let’s not procrastinate any longer, it’s about our future and the future of generations to come.

“There are not a lot of sustainable impact investment opportunities”

Yein (Yes and no). In public markets, there are plenty of organizations that are transforming and transparently sharing their journey. In private markets, there are plenty of innovative and impactful startups. Depending on your risk profile, there may be more or fewer opportunities in specific asset classes, but we will discuss about the availabilities for each asset class in the next chapters.

Photo by Elijah O’Donnell on Unsplash

So, how do I choose the impact I want to contribute to?

Impact is about ownership and responsibility, about contributing to the change you would like to see in the world. For some of us, this is very clear. My father is a psychiatrist, for him, good health and well-being are the most important of all objectives. My friend Kelly has been working with students her entire life and knows that quality education will change the world.

Courtesy: Rosa Sangiorgio

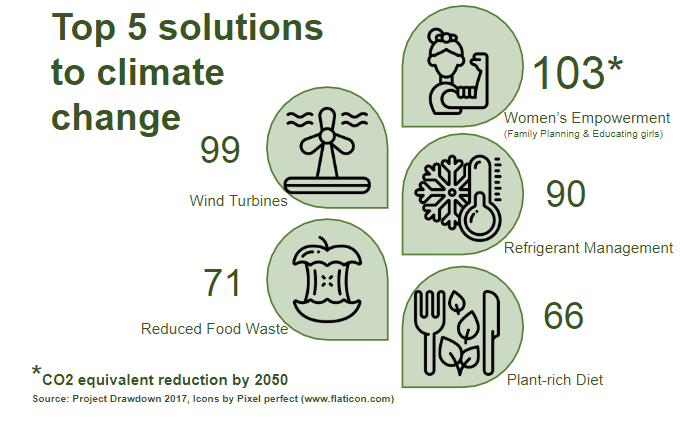

Personally, I believe that the key to every improvement we want to see in the world is education, but education takes time and generations, and we have some issues which require faster solutions than waiting for the next generation: climate change is one of them. If I can pick a third one, I will refer to the drawdown project. Did you know that the most effective measure to reduce CO2 emission and avoid climate change is reducing gender inequality? When the global impact of educating women and girls and expanding access to family planning services are combined, Project Drawdown states, it is alone the most impactful tool for addressing global warming!

Courtesy: Rosa Sangiorgio

What about you? This is the perfect time to decide which impact you want to contribute to and just go for it!

Once you’ve identified your mission and focus, investing your resources will be far more meaningful than merely “more money”.

Did you enjoy this chapter? Don’t miss out on the future ones in this series. Subscribe to our upcoming articles here.

Additional material

https://unstats.un.org/sdgs/report/2019/

Allianz Global Wealth Report, 2018

https://newclimateeconomy.report

http://businesscommission.org

http://report.businesscommission.org

https://unctad.org/en/PublicationsLibrary/wir2014_en.pdf

https://drawdown.org

About the Author:

Rosa Sangiorgio, an Independent Advisor, is an expert at scaling investment methods that generate positive, socially responsible and environmental welfare impact in addition to a financial return. She worked for several European Financial institutions in the area of Wealth Management and Private Banking. Also, she was Head of Sustainability and Impact Investing in the Investment Management team of Credit Suisse until January 2020. Rosa is also a CEFA charterholder and TEDx speaker.

Rosa Sangiorgio, an Independent Advisor, is an expert at scaling investment methods that generate positive, socially responsible and environmental welfare impact in addition to a financial return. She worked for several European Financial institutions in the area of Wealth Management and Private Banking. Also, she was Head of Sustainability and Impact Investing in the Investment Management team of Credit Suisse until January 2020. Rosa is also a CEFA charterholder and TEDx speaker.