Columns

Chapter 8: Baby steps towards the Investment Process – Investing made easy by Rosa Sangiorgio

Investing made easy is a bi-weekly series by Rosa Sangiorgio exclusively for Vivamost

Now that you’ve discovered your risk profile and time horizon and grasped which type of investments are available out there (chapter 4 and chapter 5), it is time to explore how to build and manage your portfolio.

Poster by Swetha Anusha

The “so-called” Investment Process can be summarized in three main steps that we will cover in the next chapters:

- Strategic Asset Allocation

- Securities Selection

- Portfolio Rebalancing and Monitoring

Most financial advisors would include in the process the “tactical” asset allocation, suggesting short term deviations from the strategic asset allocation to profit of market movements and cycles. I believe that this only makes sense if you are monitoring your portfolio daily or intraday (as financial advisors do). Aside from a few exceptions, in general, it doesn’t add much value to your portfolio in the long term.

Copyright: johnkwan

Strategic Asset Allocation

Your strategic asset allocation is the long-term portfolio strategy to achieve your financial and impact goals, considering your level of risk tolerance and your time horizon. It involves choosing which asset classes to invest in, and their weights in your portfolio. Key determinants of your strategic asset allocation are your return objectives, your time horizon and your risk tolerance.

Risk tolerance: if you have a high-risk tolerance, you’ll accept higher volatility. Therefore, you can allocate more to equities (or high-risk asset classes) and less to bonds and cash. Investors with a low-risk tolerance should invest less in equities and more in bonds and cash.

Investment horizon: if you have a longer investment horizon, you are able to hold during poor market conditions, without having to liquidate to meet your cash needs. For example, if you are a 20-year old student, you may afford a strategy consisting of mainly equities. If you are older, retiring in two years and needing money to fund your retirement, you may want to adopt a strategic asset allocation consisting of lower-risk assets.

Return objectives: the returns you expect from your investments significantly impact your asset allocation weights. For example, if we expect an annual return of 8% for equities, 2% for bonds, and 0% for cash, and you are looking for a 6% return of your portfolio, you will have to invest more than half of your portfolio in equities.

Photo by Vlad Bagacian on Unsplash

Why Asset Allocation Is So Important?

Asset allocation is important because it has a major impact on whether you will meet your financial and impact goals. If you don’t include enough risk in your portfolio, your investments may not earn enough return to meet your goal.

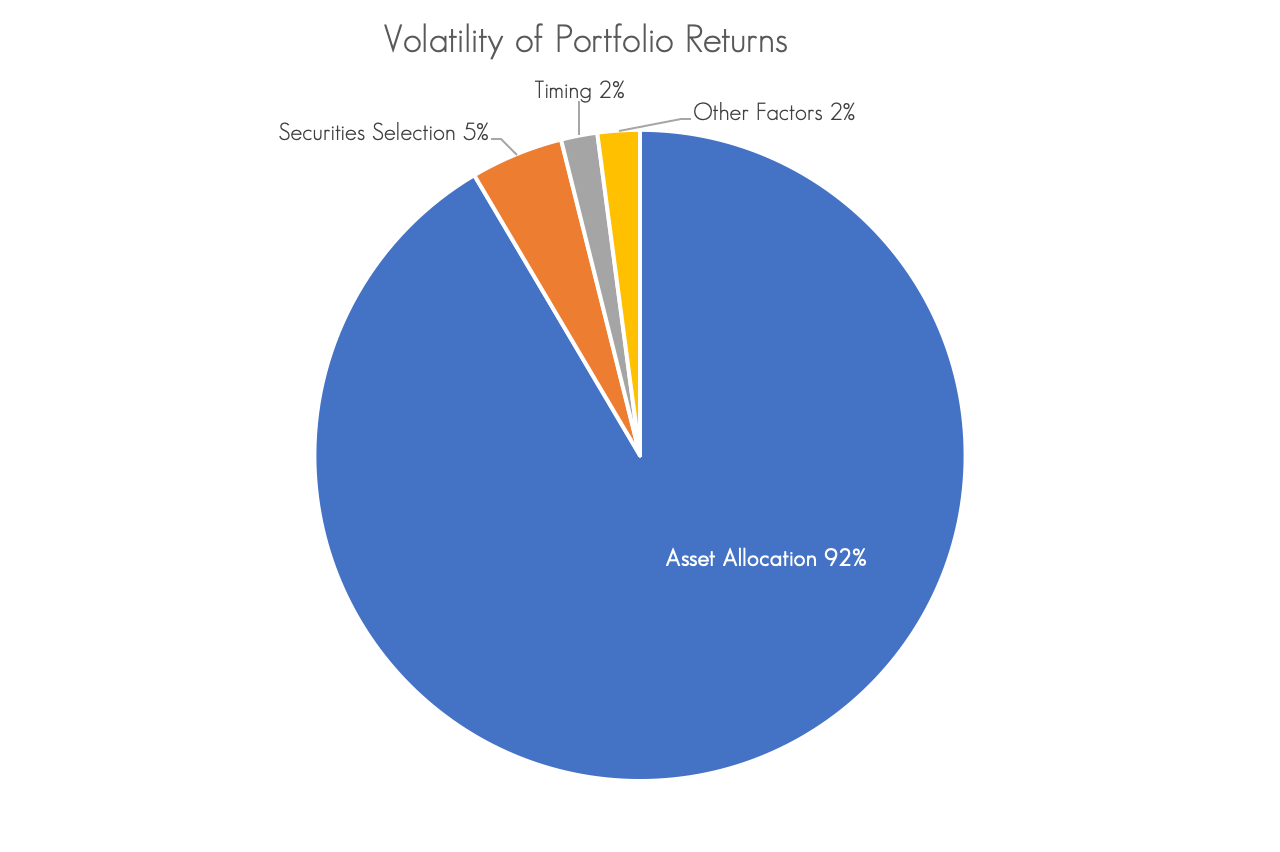

A very famous 1986 study “Determinants of Portfolio Performance” published in the Financial Analysts Journal, found that asset allocation determines more than 90% of a portfolio’s volatility (NOT performance). Another paper published in the nineties by Roger Ibbotson, stated that asset allocation does also affect performance (just not 90% of a portfolio’s performance, as often misquoted).

Source: Brinson, Hood and Beebower, “Determinants of Portfolio Performance, 1986

The magic of Diversification

The concept of Asset allocation relies on the observation that different asset classes offer returns that are not perfectly correlated to each other. When you spread money among different asset classes (not correlated to each other), if one asset class loses money, the other hopefully will make up for those losses. By investing in more than one asset class, you basically reduce the risk that you’ll lose money and your portfolio’s overall investment returns will be smoother. In financial jargon: “Diversifying across asset classes will help to optimize risk-adjusted returns”.

Most successful street vendors sell apparently unrelated products – such as umbrellas and sunglasses. It seems odd, as rarely people would buy both items at the same time. That’s exactly the point. When it’s raining, it’s easier to sell umbrellas but harder to sell sunglasses; and when it’s sunny, the reverse is true. By selling both items – in other words, by “diversifying” the product shelf – the vendor can reduce the risk of not making any business on any given day. As for the timeless saying, “don’t put all your eggs in one basket.”

Photo by Robert McGowan on Unsplash

A portfolio should be diversified both between asset classes and within asset classes. So in addition to allocating your investments among stocks, bonds, cash equivalents, and possibly other asset categories, you’ll also need to spread out your investments within each asset category. We’ll go into more detail in the Chapter about Securities Selection.

Tips and Tricks

Limit the number of asset classes

While diversifying is a good thing, too much diversification is not. You should keep a close eye on your portfolio, therefore the number of asset classes that you hold in your portfolio must not exceed what you can reasonably monitor. Holding a plethora of assets can result in confusion, and this confusion could lead to poor governance and losses.

Stick with Your Plan

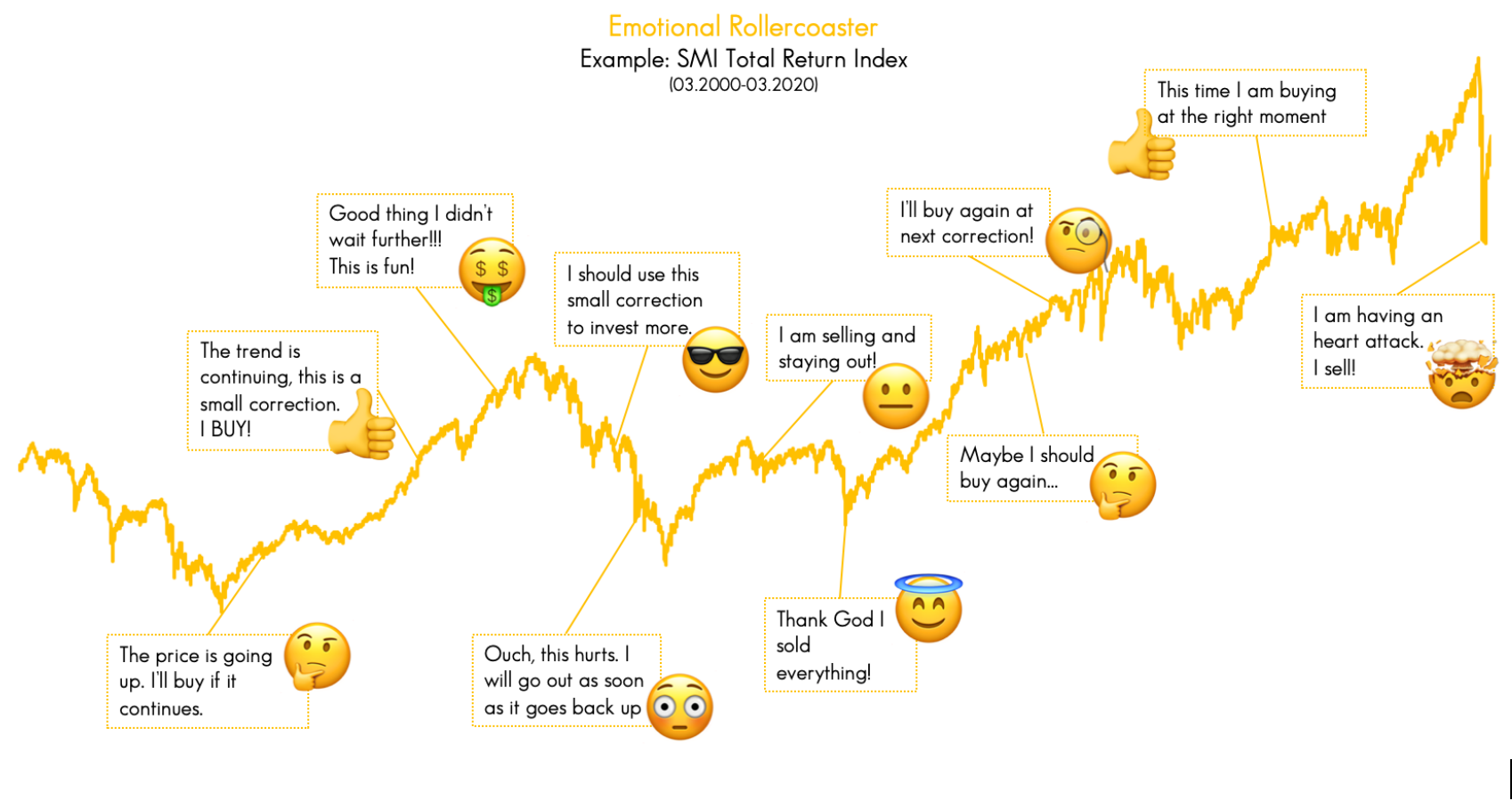

Your strategic asset allocation may change during your life, as your priorities or risk profile change. You ‘ll probably have a more “aggressive” risk profile – as a young single entrepreneur, switch into a more balanced one – when having kids, and reduce to a low risk one – once retired. The strategic asset allocation only changes with major shifts of your personal situation, not on a yearly base or depending on market cycles. Don’t try to time the market because it is the fastest way to lose your money, as investment fees and wrong entering/exit points will diminish your capital.

Be pragmatic, not emotional

You should be ready to dedicate some time to regularly analyze the performance and composition of your portfolio, to know what is happening with each asset and why. This will help you make informed decisions and maintain the health of your overall portfolio.

You don’t need to look at your portfolio every day. Markets are constantly fluctuating: panicking during downturns and buying hysteria during upturns leads to buying high and selling low. To be truly successful you must follow your initial investment strategy, and resist the temptation to buy & sell based on emotion.

Illustration by Rosa Sangiorgio

Baby steps

The less experienced of an investor that you are, the smaller proportion of equities (or other high-risk asset classes) you should hold in your portfolio.

Do it yourself!

Your asset allocation is the most important decision that you’ll make with respect to your investments, more important than the individual investments you’ll buy. With that in mind, you may want to involve a financial professional to help you with your initial asset allocation. But before you hire anyone to help you with these enormously important decisions: a) do your homework in defining your risk tolerance and investment horizon, b) do a thorough check of his or her credentials, including understanding how he or she is paid, and the potential conflict of interest.

Photo by Semen Borisov on Unsplash

Otherwise, if you understand your time horizon and risk tolerance, and have a good grasp of the different asset classes, you may feel comfortable with creating your own asset allocation. Bear with me, I will cover both the theory and practice of defining your own strategic asset allocation in the next chapter.

Additional links

About the Author:

Rosa Sangiorgio, an Independent Advisor, is an expert at scaling investment methods that generate positive, socially responsible and environmental welfare impact in addition to a financial return. She worked for several European Financial institutions in the area of Wealth Management and Private Banking. Also, she was Head of Sustainability and Impact Investing in the Investment Management team of Credit Suisse until January 2020. Rosa is also a CEFA charterholder and TEDx speaker.