Finance Column Rosa Sangiorgio

Chapter 1: Is this the right time to invest? – Investing made easy by Rosa Sangiorgio

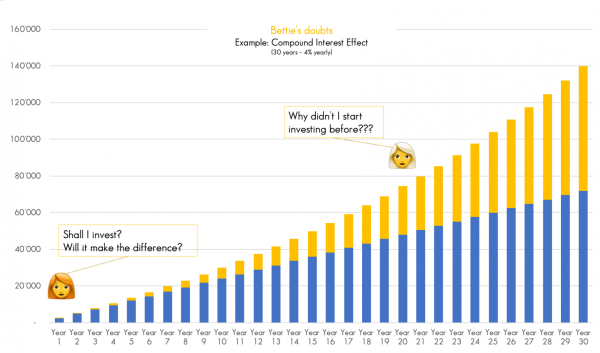

Betty was 45 years old when she decided to invest CHF 200 a month (CHF 2’400 a year). With an average yearly return of 4%, after 20 years – at 65 – she has almost CHF 75’000 (48’000 contributed, and around 27’000 of compound interests). If she had started investing when she was 35, by the time she was 65 she would’ve accumulated almost CHF 140,000. I bet she regrets that, ouch!

As a Chinese proverb says: “The best time to plant a tree was 20 years ago. The second-best time is now.”. Same story for investing, the best time to invest was the first time you had some small savings and the second-best time is now.

The mathematical reason for starting investing as soon as possible lays in the compound interest effect. If you reinvest interest (or returns) from an investment, you will accrue even more interest (returns). The longer you keep investing these returns, the greater the compound interest effect.

Illustration by Rosa Sangiorgio

You may question, “Ok Rosa, this makes sense in normal times, but we are living through an exceptional pandemic. Shouldn’t we wait until the situation clears?”

First things first, I hope that you and your family are staying healthy and safe. Secondly, yes, it’s an exceptional moment, and we don’t know when and how we will get back to normality, nor what that new normality would look like. Finally, the answer remains the same. Yes, that’s right, you should invest or stay invested.

“Time in the market” is more important than “Market Timing”

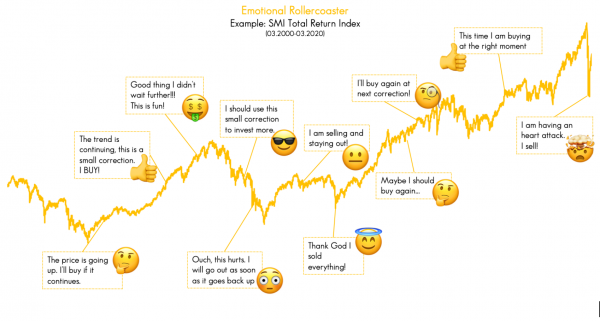

Waiting for the right timing to invest, or trying to buy at the lowest and sell at the highest (so-called “market timing”), simply doesn’t work. It’s impossible to consistently predict when a specific investment has hit its lowest or highest. Plenty of studies have shown that “time in the market” is the way to go: just stay invested, until the original reasons for investing change or you’ve reached your goals.

Infographic vector created by doodler – www.freepik.com

During the past twenty years, we had some difficult moments for many investors. The recession of 2008–2009 made some investors so fearful, they thought that divesting and keeping cash seemed a good strategy. But trying to avoid the worst drops means also missing the opportunity for gains.

If we look at the last 20 years:

- CHF 1’000 invested in the SMI would have grown to around CHF 2’300 – with an annualized return of around 4%

- Missing just the 10 best days in that period would have reduced the final amount to around 1’150 – and the annualized return to 0.7%,

- Missing the 20 best days would have put the investor in negative territory.

Of course, you could also leave the market and miss the worst days. However, studies show that people generally sell when the market is down, and they return after the market has already begun to bounce back, the perfect way to lose!

Behavior Gap – the fleeting win

We are all human, and naturally we keep close track of our money. When markets are fluctuating, the “market-timer” in each of us is tempted to sell the investment too quickly (to capture a small profit, or to avoid a loss). This is known as the “behavior gap”. As Carl Richards states, “We’re wired to avoid pain and pursue pleasure and security. It feels right to sell when everyone around us is scared and buy when everyone feels great. It may feel right – but it’s not rational”. Unfortunately, once we’ve sold, it’s not easy to identify when we can get back in, and usually we get back in too late and after a tough emotional rollercoaster!

Illustration by Rosa Sangiorgio

Again, rather than trying to predict highs and lows, it’s important to stay invested through the ups’n’downs and focus on the time you stay invested, not the timing of your investments.

Investing your money will support your financial stability, not destroy it.

“But, where do I start? I am scared to invest wrongly and lose my money. I’m not really a numbers person”, you might wonder.

Investing doesn’t need to be the aggressive zero-sum game, where someone wins and someone loses, and you have to beat the market. The best strategy is to invest gradually in a diversified portfolio, aligned with your investor profile, preferably paying low fees. How to recognize your needs and values (your so-called investor profile), what is a diversified portfolio, and how to build your long term investment plan will be the topics of next weeks’ articles! Imagine, how cool will it be, when you learn to use your money for positive change, not just for yourself, but for your family and the causes you believe in too.

Don’t miss out on the updates on this series. Subscribe to upcoming articles here.

Don’t miss out on the updates on this series. Subscribe to upcoming articles here.

Further interesting readings:

- Market Timing – https://www.investopedia.com/terms/m/markettiming.asp

- https://en.wikipedia.org/wiki/Market_timing

- Benjamin Graham’s “The Intelligent Investor”

- Erin Lowry’s “Broke Millennial Takes On Investing”

- Daniel Kahneman “Thinking, Fast and Slow”

- Carl Richards “The One-Page Financial Plan: A Simple Way to Be Smart About Your Money”

- Carl Richards “The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money”

- Aysha van de Paer, Tedx “What every woman needs to know to close the gender gap”

About the Author:

Rosa Sangiorgio, an Independent Advisor, is an expert at scaling investment methods that generate positive, socially responsible and environmental welfare impact in addition to a financial return. She worked for several European Financial institutions in the area of Wealth Management and Private Banking. Also, she was Head of Sustainability and Impact Investing in the Investment Management team of Credit Suisse until January 2020. Rosa is also a CEFA charterholder and TEDx speaker.