Finance Column Rosa Sangiorgio

Chapter 13: It’s never too early to plan your pension – Investing made easy by Rosa Sangiorgio

Investing made easy is a bi-weekly series by Rosa Sangiorgio exclusively for Vivamost

“If I had known I was going to live this long, I would have taken better care of myself.”

― Mae West

We all want to believe that old age is still a long way away. The ideal approach, though, is to start thinking about the matter as early as possible.

Image by Arek Socha from Pixabay

If you, like me, are living in Switzerland, consider yourself lucky! The Swiss Pension system is one of the most reliable in the world. That said, reliable does not always mean easy to understand, and the multitude of acronyms plus three official languages doesn’t help! In this article, I’ll summarize the basics and provide you a few links to explore for more detail.

Photo by JACQUELINE BRANDWAYN on Unsplash

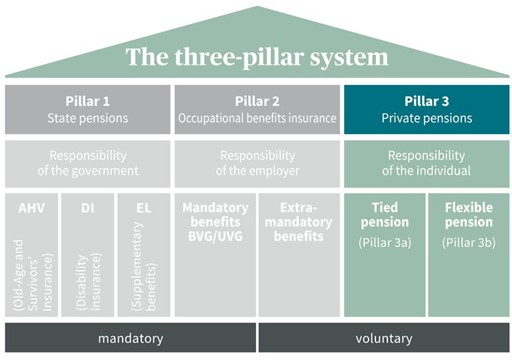

The Swiss Pension system includes:

- state protection of basic livelihood (first pillar),

- occupational benefits insurance (second pillar),

- and tax-privileged private pension provision (third pillar).

Image Source: www.axa.ch

1st pillar: State pensions

The 1st pillar includes:

Old Age and Survivors’ Insurance:

- in German. Alters und HinterlasseVersicherung – AHV

- In French: Assurance Vielliesse et Survivants -AVS

- in Italian: Assicurazione Vecchiaia e Superstiti – AVS

Disability Insurance:

- in German: Invalidenversicherung – IV

- in French: Assurance-invalidité – AI

- in Italian: Assicurazione per l’invalidità – AI

Insurance for loss of earnings during service and maternity,

- in German: Erwerbsersatzordnung / Mutterschaftsentschädigung – EO / MSE

- in French: Allocations pour perte de gain en cas de service et de maternité – APG

- in Italian: Indennità di perdita di guadagno / Maternità – IPG

Unemployment insurance:

- in German: Arbeitslosenversicherung – ALV)

- in French: Assurance chômage – AC

- in Italian: Assicurazione contro la disoccupazione – AD

Photo by Hansjörg Keller on Unsplash

As a general rule, if you are domiciled in Switzerland and are employed, you pay AHV, IV, EO and ALV contributions, deducted directly from your salary. If you are self-employed, you have to pay directly AHV, IV and EO, but not ALV, therefore not insured against unemployment nor subject to mandatory occupational pension provision (see next paragraph on 2nd pillar).

Your entitlement to a pension from Pillar 1 is calculated on the basis of your individual account (IC). Depending on the average income earned and the resultant AHV deductions paid, the normal full pension is at least CHF 1’185 and at most CHF 2’370.

2nd pillar: occupational pension

CHF 2’370 is definitively not sufficient for ensuring retiring with a good standard of living. For this reason, all employees insured under the 1st pillar and who earn at least CHF 21’330 a year (data as of 2019) have to be insured under the 2nd pillar too.

Photo by krakenimages on Unsplash

The law covering the second pillar is:

- in German: the Bundesgesetz über die berufliche Alters-, Hinterlassenen- und Invalidenvorsorge – BVG

- in French: it’s called Loi fédérale sur la prévoyance professionnelle vieillesse, survivants et invalidité– LPP

- in Italian: Legge federale sulla previdenza professionale per la vecchiaia, i superstiti e l’invalidità – LPP

That’s why, when talking about 2nd pillar you’ll often hear the terms BVG and LPP.

Usually, it’s your employer that chooses the pension fund with which you are insured, and you and your employer pay monthly an amount into this occupational pension account, with the size of the amount depending on your salary, your age and your pension plan. This second pillar consists of a mandatory portion (annual salaries up to a specified maximum amount – around 80k – are insured in the mandatory portion) and a voluntary portion.

Image by Wilfried Pohnke from Pixabay

The investment strategy of any second pillar pension fund is determined by the Board of Trustees of that fund. However, they’re legally required to guarantee a minimum interest rate to the mandatory portion, which is set each year by the Swiss Federal Council (currently at 1% – more than most banks offer on cash accounts). Pension funds can set their own interest rates on the voluntary portion.

When you retire, you can choose between receiving your pension fund assets as a lump sum, or as a lifelong pension. In case you choose a lifelong monthly pension, the minimum conversion rate is 6.8% (at the time of writing). If you’ve saved CHF 100,000.00 in your second pillar, you’ll receive CHF 100,000 × 6.8% conversion rate = CHF 6,800.00 per year. Bear in mind that your pension fund’s regulations may contain a higher conversion rate.

Should you die before you retire, your surviving dependents will receive a share of your pension fund assets, either as a widow’s and orphan’s pension or as a lump-sum payment. Should you become unable to work before you retire, you’ll receive a disability pension or a lump-sum payment.

Image by pasja1000 from Pixabay

If you change employer, you’ll be required to transfer your pension assets from the pension fund of your former employer to that of the new one. In this way, your total assets are insured at one single pension fund at all times. If you no longer have an employer, you’re required to deposit your pension fund assets in a special account.

If you purchase a residential property for your own use, you can make an early withdrawal of a portion of your pension fund assets. If you sell the property again, the money must be repaid into your pension fund. Only if you permanently emigrate abroad or become self-employed can you withdraw the entire balance.

3rd pillar: Private pensions

The first and second pillar cover “only” about 60 to 75% of the last salary. Depending on your income, it may even be less than that. The third pillar, which is voluntary and supported by both the Federation and cantons (via tax breaks), is intended to supplement your income after retirement.

Image by Greg Plominski from Pixabay

A distinction is made between pillar 3a and pillar 3b. Pillar 3a is capped at an annual maximum contribution (currently around CHF 6k) and is subject to certain restrictions, but you can deduct it from your annual taxes. Pillar 3b is subject to fewer restrictions but has no direct tax benefits.

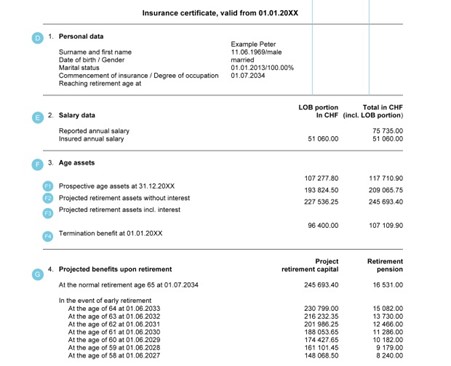

Every year you should receive a report from your Pension Fund telling you how much you have contributed and predicting how much you will have by retirement. Learn how to read those documents, they contain important information about your future!

Example of the document from the website: https://www.helloswitzerland.ch/magazine/-/pension-insurance-certificate

As mentioned at the beginning, the objective of this article was to give you a kick-start, a first idea about the fascinating world of Pension Funds, and to clarify some of the acronyms. It’s not supposed to be comprehensive, and may become outdated, for this reason, here are a series of links to explore and to keep yourself up to date.

Image by pasja1000 from Pixabay

More info:

- https://www.vita.ch/en/pension-plan-related-issues/pension-provisions-explained-in-simple-terms/three-pillar-system

- https://www.ch.ch/en/manage-retirement-provision/

- https://www.bsv.admin.ch/bsv/en/home/social-insurance/bv/grundlagen-und-gesetze/grundlagen/sinn-und-zweck.html

About the Author:

Rosa Sangiorgio, an Independent Advisor, is an expert at scaling investment methods that generate positive, socially responsible and environmental welfare impact in addition to a financial return. She worked for several European Financial institutions in the area of Wealth Management and Private Banking. Also, she was Head of Sustainability and Impact Investing in the Investment Management team of Credit Suisse until January 2020. Rosa is also a CEFA charterholder and TEDx speaker.

very useful, clear and straight forward. very well done! I spent years to understand all this and was not able to retrieve such a support on the web.

I personally would also add a paragraph about the years of contribution either in the 2nd and 3rd pillar. For those that came in Switzerland in mature age and could not count on a compound effect starting those two pillars very early in their career, fewer years of contribution makes quite some difference.

Absolutely Nico!!!!

How much you pay for the second pillar depends on your age:

– 25 to 34 years old: 7%

– 35 to 44 years old: 10%

– 45 to 54 years old: 15%

– 55 to 64/65 years old: 18%

Basically, as you get older, you put more and more into your second pillar. It means that the last years matter a lot in the calculations of your second pillar pension.